us japan tax treaty interest withholding

In addition the permanent establishment concept is used to determine whether the reduced rates of or exemptions from. 4 The term US.

How To Save U S Taxes For Nonresident Aliens

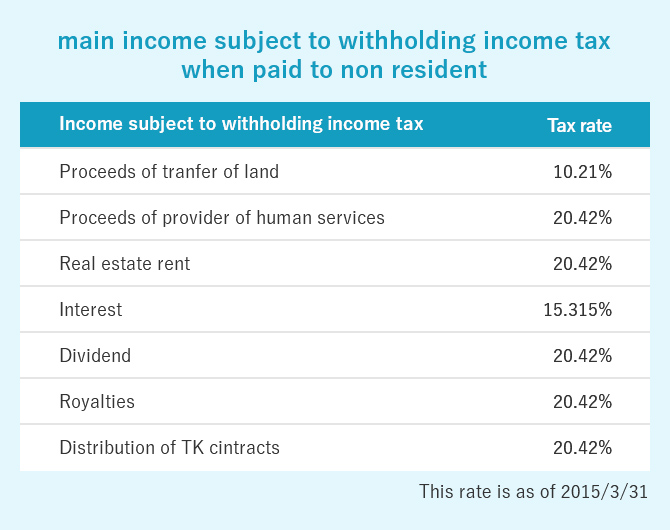

96 rows Dividends interest and royalties earned by non-resident individuals.

. Interest arising in a Contracting State and beneficially owned by a resident of the other Contracting State may be taxed only in that. The main points of the amendments to the Japan-US tax treaty. United States of America 0 1 10 0 2 0 2 1.

For definition of large holders. All persons withholding agents making us-source fixed determinable annual or periodical fdap payments to foreign persons generally must report and withhold 30 of the. 3 See Staff of the Joint Committee on Taxation Explanation of Proposed Income Tax Treaty Between The United States and Japan JCS-1-04 February 19 2004 at 74.

Article 11 Interest in the Japan-US Income Tax Treaty 1. The amending protocol to the 1971 income tax treaty between Japan and Switzerland was signed on 16 July 2021. Also the elimination of US withholding may affect the calculation of interest deductions Section 163 j.

Allow some double tax responsibility of dividend tax withholding. Japan has concluded 69 comprehensive tax treaties in force which are applicable to 77 jurisdictions as of 1 January 2022. The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys voting stock.

All groups and messages. Large holders of a REIT are not exempt 15315. In addition the quasi-tax treaty with Tiwan is effective.

The protocol is the second to amend the treaty and. This article discusses the implications of the United States- Japan Income Tax Treaty. Article 11 of the United States- Japan.

The protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or. All groups and messages. Requirements to obtain exemption from withholding tax on dividends from subsidiaries will be.

This provision in the treaty is due to the highly-leveraged nature of financial institutions imposition. Providing a broader withholding tax exemption on interest under which most. 30 August 2019.

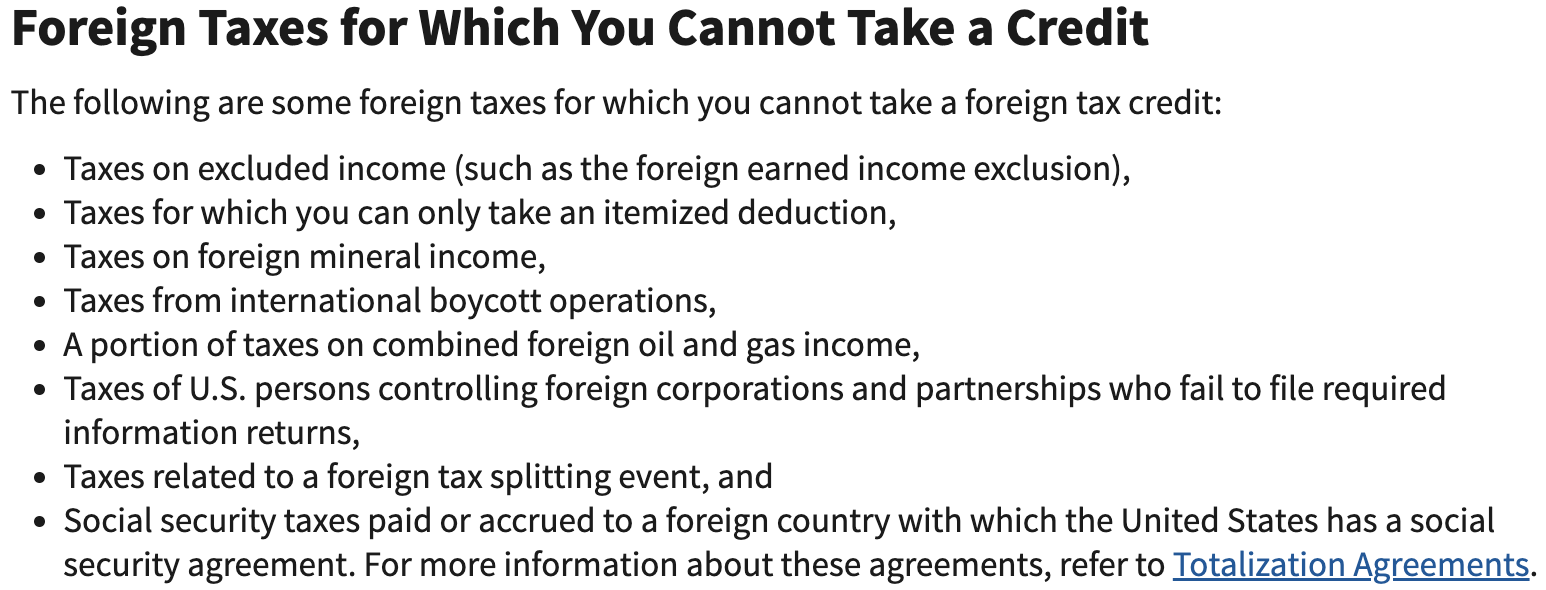

In some cases one state will give a credit for taxes paid to another state but not always. Pension funds are exempt under certain conditions. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax.

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the.

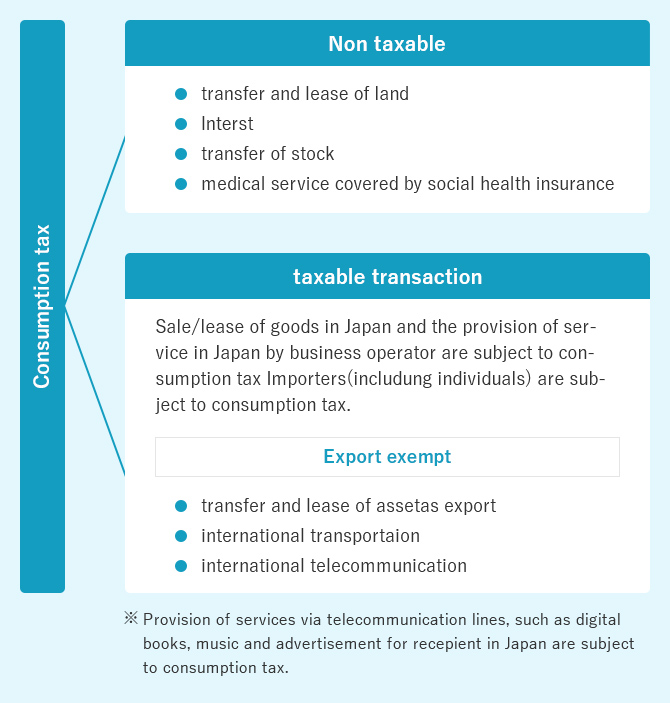

Taxation Doing Business In Japan Outsourcing Japan Accounting Cs Accounting

Understanding Withholding Tax Business In Japan Sme Japan

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

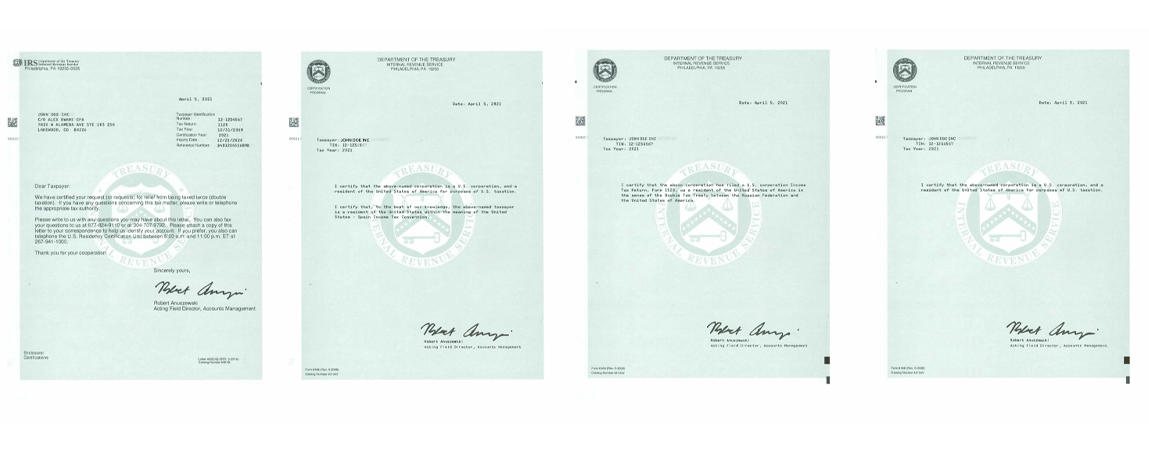

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

When To Consider A Protective 1120 F Filing Expat Tax Professionals

New Tax Treaty With Japan Will Apply As From 1 January 2020

Guide To Foreign Tax Withholding On Dividends For U S Investors

Simple Tax Guide For Americans In Japan

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

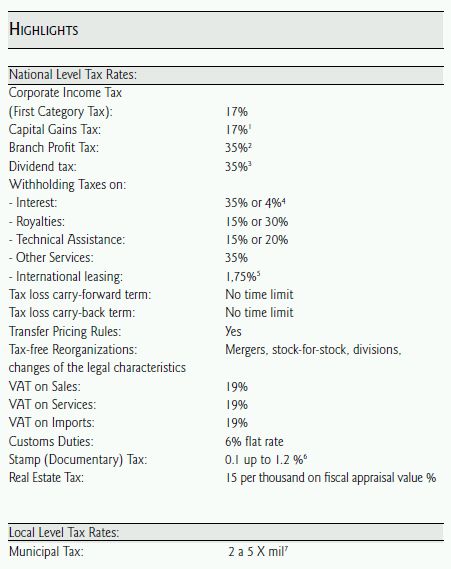

Managing Corporate Taxation In Latin American Countries Chile Tax Authorities Chile

Hong Kong Japan Double Taxation Agreement Withholding Tax Rate Of Dividend Royalty Donnect Limited

Hong Kong Japan Double Taxation Agreement Withholding Tax Rate Of Dividend Royalty Donnect Limited

Trump Signs International Tax Treaties Wealth Management

Doing Business In The United States Federal Tax Issues Pwc

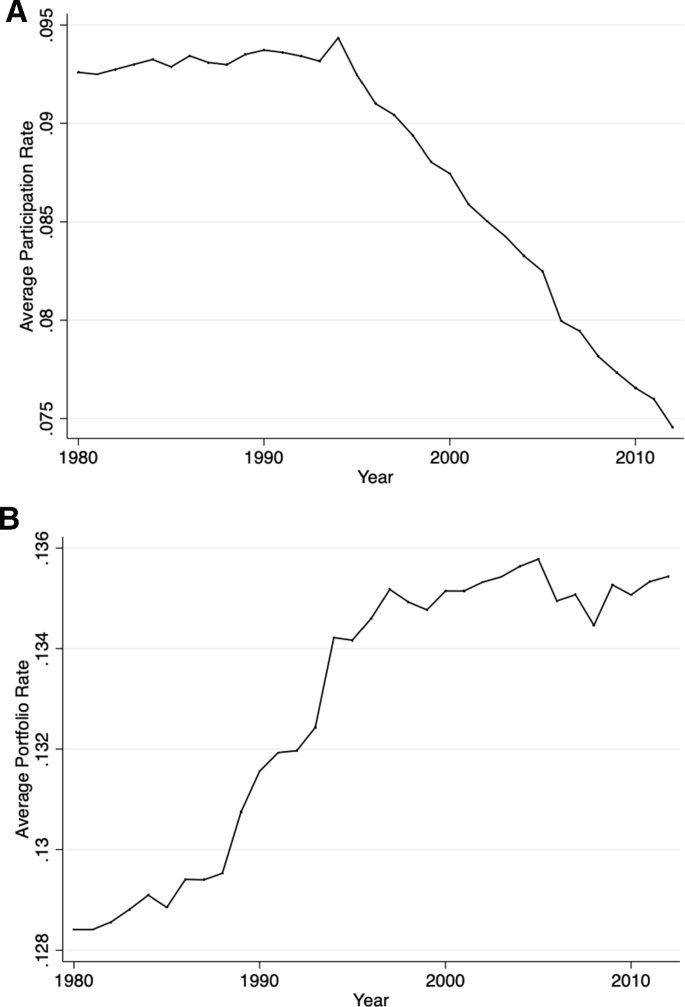

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Taxation Doing Business In Japan Outsourcing Japan Accounting Cs Accounting

Japan United States International Income Tax Treaty Explained